Experiencing an insurance repudiation can be a highly stressful situation and can potentially cause significant financial burdens. As a policyholder, it is important to recognize that even if you have been honest and innocent in your claim, it can still be repudiated on technicalities that may exceed your level of expertise.

During the initial assessment of your risk, insurance companies will ask various questions such as your age, sex, address, assets, and prior claims history. Based on the level of risk associated with insuring you, they will provide a rate – the cost of insurance – which represents the cost of carrying your risk on your behalf.

It is important to note that insurance companies operate as businesses and therefore have a for-profit model. Their profitability is typically derived from either collecting more money from paying clients or paying out less money for claims.

It is not reasonable to assume that insurance companies will cover all of your losses simply because you have diligently paid your premiums for years or decades. Your relationship with your insurer will be different when you are initially on-boarded as a client versus when they are denying your claim.

To protect yourself from an insurance repudiation or to fight one if it occurs, it is essential to familiarize yourself with the necessary steps. Therefore, we encourage you to carefully review the following guidelines.

Being involved in a car accident can be a stressful and traumatic experience, but it is important to remain calm and focused. The first step in fighting an insurance repudiation is to gather as much information as possible about the incident. This includes obtaining the names and contact information of all parties involved in the accident, including drivers, passengers, and any witnesses who may have seen what happened.

In addition to gathering contact information, it is also important to take note of the make and model of any vehicles involved in the accident, as well as their license plate numbers. If possible, take photographs of the scene of the accident, including any damage to the vehicles, the location of the accident, and any other relevant details.

If the police are called to the scene of the accident, it is important to obtain a copy of the police report, as this will provide an official record of the incident. If the police do not attend the scene, be sure to report the accident to them as soon as possible, as this will also help to create an official record.

By gathering as much information as possible about the accident, you will be better equipped to file an insurance claim and fight any potential repudiation. It is important to remain calm and focused throughout this process and to seek professional help if necessary. An experienced lawyer or insurance expert can provide guidance and support, and help you to protect your rights and get the compensation you deserve.

Reporting the crash to the police is a crucial step in the aftermath of an accident. It is highly recommended that you do this within 24 hours of the incident, or as soon as possible if the police did not attend the scene. By reporting the accident to the police, you create an official record of the incident that can be used as evidence in any future proceedings.

Not only does a police report provide an objective account of the accident, but it also helps to protect your legal rights. The report can provide vital details about the accident, such as the date, time, location, and a summary of the events leading up to the collision. It may also include the names and contact information of any witnesses to the accident.

In some cases, failing to report the accident to the police within a certain timeframe may result in penalties or fines. Additionally, not reporting the accident may cause issues when trying to file a claim with your insurance company. Therefore, it is important to report the crash to the police as soon as possible.

When you file an insurance claim, the insurer will typically request a copy of the police report. Having this information readily available can speed up the claims process and help to ensure that you receive the compensation you are entitled to.

After an accident, the next step is to submit an insurance claim. This is a crucial step in the process, as it allows you to seek compensation for any property damages sustained in the collision. When submitting your claim, it’s important to be diligent and accurate in your reporting.

You should limit your claim to the details about the collision in the most general terms possible – don’t get too specific yet. This means avoiding providing too much information that may not be relevant to the accident, or that may be misinterpreted in the absence of context. It’s essential to be honest in your reporting and to provide accurate information about the collision. This can help to avoid any claims of misrepresentation in your claim, later on.

This might sound like a contradiction, but here are some examples:

You might want to say the following…

But rather word it like this…

I met some friends after work, on Friday night, at Joe’s Bistro on Main Road. We all arrived at about 7PM and we had a few drinks, but I didn’t drink at all. We also ate and I left at about 11PM. As I was driving home, I was driving on Second Street. Suddenly, a pedestrian ran out in front of me. I didn’t see him until it was too late, so I swerved not to hit him and left the road and drove into a ditch.

On the night of the loss I was traveling home when a pedestrian stepped out in fromt of my vehicle, exposing me to a sudden emergency. In an attempt to avoid colliding with the pedestrian, I swerved, causing my vehicle to lose control.

I was driving on Main Road and traffic was busy. Suddenly, the guy in front of me slammed on brakes, like literally right in front of me. I was so surprised that I had no time to stop, so I rode into the back of his car, but it was his fault because there was no reason for him to stop.

As I was driving on Main Road, the vehicle ahead of me applied brakes suddenly and without warning. Despite my best efforts, I failed in my attempt to stop as well.

Think about the details you provide carefully. Be factual, but only as far as explaining how the accident (the loss) occurred. Everything that happened before, and after, can be the subject of further investigation. This is not a suggestion that you hide anything, but something as simple as getting the time of your arrival and departure, or the names of the people that were present wrong, can be interpreted as “not providing truthful information,” and expose you to possible repudiation.

It’s important to remember that the accuracy of the information you provide in your claim can impact the outcome of your claim. If there are any inconsistencies or discrepancies in your claim, this could lead to a denial of coverage. Therefore, it’s vital to ensure that your claim accurately reflects the facts of the accident.

Once you have submitted your claim, the insurance company may contact you for additional information. They may also assign an investigator to “verify the details of the claim.” It’s important to cooperate with the investigator and to provide any requested information, but only if you are comfortable and satisfied that the information is needed, and how it will be used.

If you can – record any conversations you have with insurance investigators and do not be scared to ask why they need certain particulars. It is true that you must be honest, transparent, and forthcoming in your cooperation with the insurer, but your Privacy is protected under law, and the information you provide is subject to certain conditions, such as knowing why they want the information, and what it will be used for.

One example of information that is of no use in a car accident claim might be your banking statements or call records. Only if the insurer reasonably suspects that you were drinking, and can prove that you were alone, might your bank statements reveal anything. Your phone records might reveal that you never called the police.

Remain vigilant and ask for a detailed explanation of what information is required, EXACTLY, and how that information will be used. Once you have established how the information will be used, you might want to limit access – perhaps only providing bank details or phone calls for the evening of the accident, and removing or redacting your bank balance or incoming calls. If you are unsure about anything, it’s recommended that you seek professional help.

If you receive notification that your insurance claim is being verified, it is highly recommended to seek professional help immediately. It is crucial to ensure that your rights are protected and that you receive the compensation you deserve. A skilled attorney or accident expert can provide guidance on how to handle the verification process, ensuring that your claim is not unfairly denied or reduced.

Insurance companies may use a variety of tactics during the verification process, such as questioning the legitimacy of the accident, the extent of your damages, or the validity of your version. They may also investigate your background, medical history or previous insurance claims to find any discrepancies that could be used to deny your claim.

With the assistance of a legal professional or crash expert, you can be sure that your claim is being handled properly and that you are not being taken advantage of by the insurance company. They can also assist in providing any necessary documentation or evidence to support your claim, which can improve your chances of a successful outcome. Remember, the insurance company has its own team of experts, so it’s essential to have someone on your side who can level the playing field and fight for your rights.

In the unfortunate event that your insurance claim is denied, it is important to take action and dispute the decision. Submitting a dispute with your insurer is a crucial step in the process of fighting an insurance repudiation, as it provides an opportunity to resolve the issue without resorting to legal action. But still get expert assistance with the preparation of that dispute.

When submitting your dispute, it might be necessary to include all relevant information and documentation to support your claim. This can include any police reports, medical records, witness statements, and photographic evidence of the accident scene and any damages. In some cases, you might need to be as specific and detailed as possible, outlining the reasons why you believe the decision to deny your claim is unfair or unjustified.

In addition to providing evidence, it’s important to clearly explain your position and why you believe you are entitled to compensation. This can include a detailed breakdown of the costs associated with the accident, references to parts of your policy wording, property damage, and even consequential losses. If you have any additional information or details that you feel may be relevant to your claim, it’s important to include those as well, if you are advised to, at this stage.

It’s important to keep in mind that the dispute process can be complex and time-consuming, so it’s advisable to seek legal advice or assistance from a professional who is experienced in handling insurance disputes. They can help you navigate the process and provide guidance on the best way to present your case. With the right approach and a strong case, you may be able to resolve your dispute with your insurer and receive the compensation you deserve.

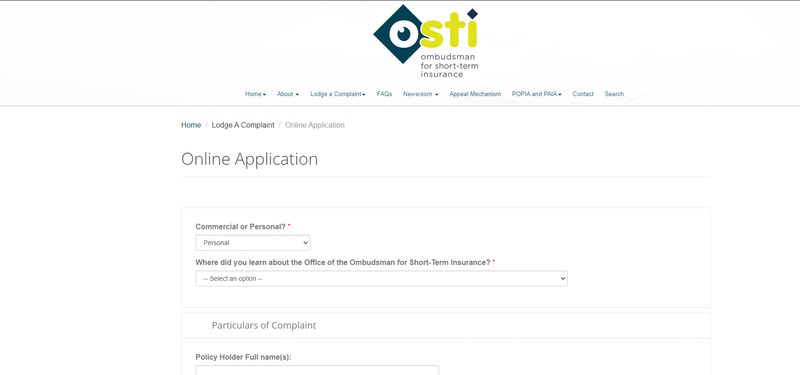

If your dispute with the insurer is not resolved, you have the option to submit a complaint to the Ombudsman for Short-term Insurance, which is an independent body responsible for investigating complaints against insurers.

When submitting your dispute or complaint, it is important to focus on the specific issue at hand, which is the mistake made by the insurer in denying your claim. Avoid getting sidetracked into arguments about how the accident occurred or who was at fault. Keep your dispute concise and to the point, outlining the specific details of the claim and the reasons why you believe it was wrongfully denied.

When submitting your dispute or complaint, it is essential to request all relevant reports, images, and recordings related to the incident. This information will help to support your case and ensure that you have all the necessary evidence to make a strong argument. It is also crucial to ensure that your dispute or complaint includes all relevant documentation, such as the police report, medical reports, and repair estimates.

Additionally, it is important to provide a clear and concise summary of the events leading up to the claim denial, including any communications or interactions you had with the insurer. This will help the Ombudsman to understand the full scope of the dispute and make an informed decision. Finally, be sure to provide any other supporting evidence, such as witness statements or expert opinions, that may help to strengthen your case.

If you have exhausted all options and the Ombudsman takes longer than three, or maybe six months to make a finding, you may need to take legal action and sue the insurer. This process can be complicated, expensive, and time-consuming. It is crucial to seek professional legal help if you decide to take this route.

Here are some important things to keep in mind when considering legal action against an insurer:

- Understand the legal process involved in suing an insurance company, including the required documents and legal procedures.

- Gather all the necessary evidence to support your case, including medical reports, witness statements, and any other relevant information.

- Engage your own expert, who will conduct an investigation, prepare a report, review the insurer’s expert reports, and guide you on the issues relating to the reliability of expert findings.

- Consult with a lawyer who has experience in insurance law to ensure that your case is strong and well-supported.

- Consider the costs involved in taking legal action and make sure it is financially feasible for you.

- Be prepared for a potentially long and stressful legal battle.

In summary, it is important to exhaust all other options before considering legal action against an insurer. If you do decide to sue, seek professional legal help, gather all necessary evidence, and understand the costs and potential challenges involved.