Insurance-related content

Experiencing an insurance repudiation can be a highly stressful situation and can potentially cause significant financial burdens. As a policyholder, it is important to recognize that even if you have been honest and innocent in your claim, it can still be repudiated on technicalities that may exceed your level of expertise.

During the initial assessment of your risk, insurance companies will ask various questions such as your age, sex, address, assets, and prior claims history. Based on the level of risk associated with insuring you, they will provide a rate – the cost of insurance – which represents the cost of carrying your risk on your behalf.

It is not reasonable to assume that insurance companies will cover all of your losses simply because you have diligently paid your premiums for years or decades. Your relationship with your insurer will be different when you are initially on-boarded as a client versus when they are denying your claim.

To protect yourself from an insurance repudiation or to fight one if it occurs, it is essential to familiarize yourself with the necessary steps. Therefore, we encourage you to carefully review the following guidelines.

With a rather dismal road safety record and hundreds of thousands of road crashes yearly in South Africa it is rather irresponsible to drive with a vehicle that is not insured. Car Insurance, even though sometimes seen as a “Grudge Purchase” may save you from lengthy legal battles with other road users. Perhaps most important though is that car insurance will provide peace of mind that you will not be left to deal with severe financial hardship in having to replace your vehicle.

Well, this is part of the theory of it! All is, however, not that simple. The contract with your car insurer will also require you to fulfill YOUR contractual obligations to ensure that the insurer is not burdened with limitless liability. It would only be fair to accept that an insurer will only pay for those damages that could be foreseen – and not for damages caused by lawlessness such as drunk and reckless driving!

With a rather dismal road safety record and hundreds of thousands of road crashes yearly in South Africa it is rather irresponsible to drive with a vehicle that is not insured. Car Insurance, even though sometimes seen as a “Grudge purchase” may save you from lengthy legal battles with other road users. Perhaps most important though is that car insurance will provide peace of mind that you will not be left to deal with severe financial hardship in having to replace your vehicle.

Well, this is part of the theory of it! All is however not that simple. The contract with your car insurer will also require you to fulfil YOUR contractual obligations to ensure that the insurer is not burdened with limitless liability. It would only be fair to accept that an insurer will only pay for those damages that could be foreseen – and not for damages caused by lawlessness such as drunk and reckless driving!

Insurance Brokers are more than specialists at reducing the cost of insurance. Any Broker worth their salt would develop a long-standing relationship with their clients, advise them towards a product that benefits them in the short- and long-term, and stand by them when a claim must be processed. When it comes to the preparation, submission, and motivation of claims, the Broker becomes the go-to for most of their clients. It is their experience, expertise, insider awareness, and direct lines of access that their clients typically rely on.

When a Broker submits a claim to an insurer, on behalf of a client, they are typically expert the claims process to proceed in line with their long-term experience. But what if that has changed, if that is changing, or if it is about to change? How can the Broker best advice, assist, and represent their clients when the dynamics change dramatically and if insurance repudiations increase?

“These days, people are approaching me with all manner of nothing less than horror stories about their repudiation experiences. In one case, my client had been asked to come in and talk to his insurance company about his motor accident claim after another driver drove into him. He willingly went, under the – sometimes misguided – belief that honesty and openness is the best policy. Upon arrival, he found himself subjected to an interrogation more akin to a trial than the friendly cat he was expecting. One of the questions he was asked, among many others, was whether he had had anything to drink on the night of the collision. In honestly, and believe in always telling the truth, he answered that he did have one beer much earlier in the evening. He was later mortified to learn that his claim had been repudiated because he admitted that he was under the influence of a drug – a clear policy violation. He was in material breach. His claim was never paid.”

As South Africa is reeling from a series of flooding, from the notorious KZN floods to the intense rains that have been relentlessly falling in several provinces, Drivers might be unaware of the implications of driving into rainwater, when this results in damages. If you look at the Ombudsman for Short-Term Insurance’s Briefcase from March 2016, the following Case Study should be seen as a warning for those thinking it’s okay to drive through deep pools of water.

The insured reported that his vehicle was damaged after he drove it through a flooded road. He said that the vehicle stopped immediately and would not start or shift gears. A service provider appointed by the insurer stated that the vehicle suffered damage to the engine as a result of ‘water being sucked into the engine when the insured drove over water on the road’. The service provider found that the air cleaner was wet, and the intercooler was full of water.

The insurer concluded that the damage was not covered because the vehicle only sustained damage to the engine. The insurer quoted the following exclusion from the policy wording in its rejection letter…

On the Arrive Alive website, we share many reports from road crashes across South Africa. The objective is not only to keep the public informed of road crashes but also to investigate and expose the contributing factors to road crashes. This allows us to share information and advice on preventing these crashes and make our roads safer.

A very important theme is that of Speed. We emphasize that drivers/bikers should both obey the Rules of the Road and the Speed Limits and also adjust speed where the road, traffic and weather conditions necessitate a reduced speed to be safe.

When the road crashes are those involving “high profile people’ many find themselves trying to be “crash analysts” or “forensic crash investigators” and are quick to jump to conclusions on what has happened, what caused the crash and who is to blame…

I come across this all the time: People have their insurance claims repudiated (rejected) or they face criminal charges, based on speed data acquired from so-called “Tracker Reports.”

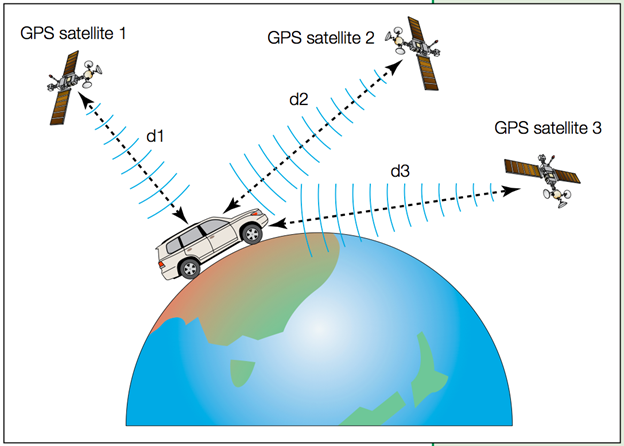

Most modern vehicles in most countries where asset recovery is a topic of interest are fitted with some or other “Tracking System.” The system is either installed by design or installed afterward. In countries like South Africa, where vehicle hijackings and theft is a major issue, most insurers might insist on the installation of a “VESA-approved tracking and recovery device” as a condition of cover.

The truth is that the VESA standard is rather vague, really. According to the website of the Motor Vehicle Security Association of South Africa (VESA), the following are the guidelines with regards to their standards: